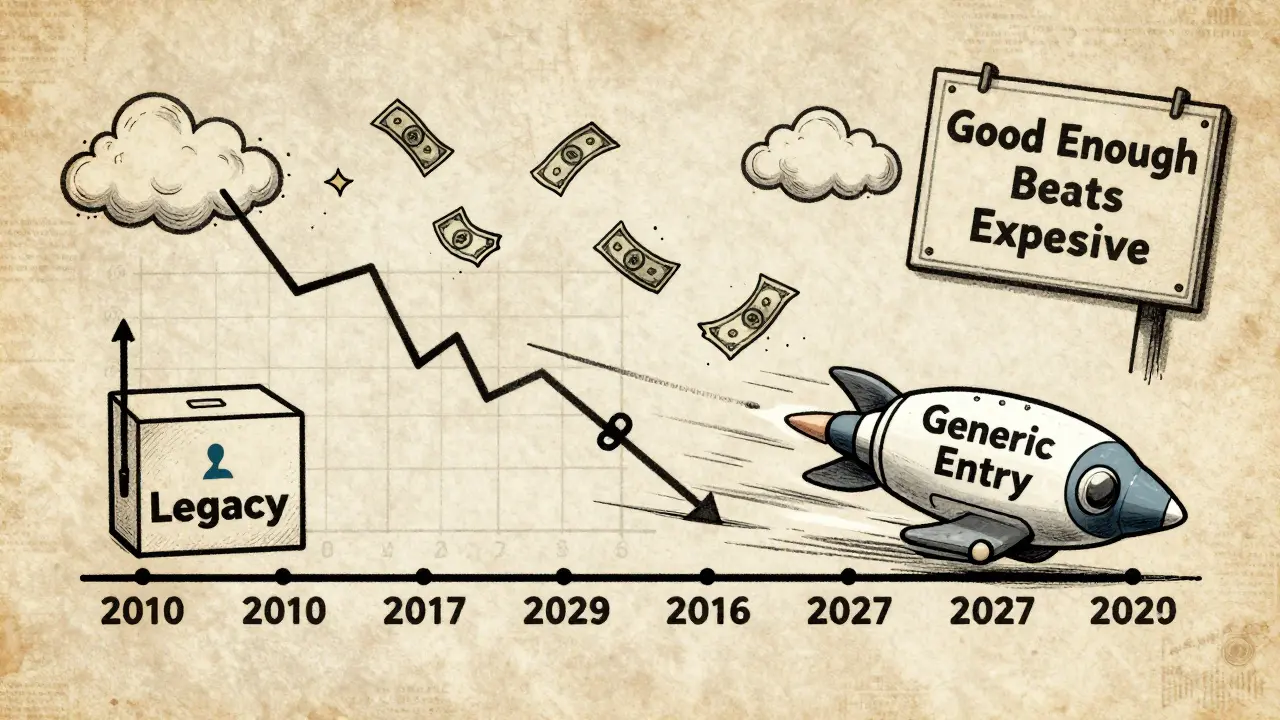

Have you ever noticed how a product launches at a high price-then, within months, it’s half the cost? This isn’t just a sale. It’s a pattern. And it happens every time a first generic entry hits the market.

What Is a First Generic Entry?

A first generic entry is when a new company releases a version of a product that does the same thing as a popular, branded one-but at a fraction of the cost. Think of it like this: Apple launched the iPod in 2001 for $399. A few years later, companies like SanDisk and Creative started selling digital music players for under $50. Same function. Different price. That’s a first generic entry. It’s not just hardware. In software, when Oracle charged $50,000 per license for its database, companies like PostgreSQL and MariaDB came in with free or low-cost alternatives. Within a year, businesses were switching. Why? Because they didn’t need the brand. They just needed the job done.Why Do Prices Crash So Fast?

It’s not magic. It’s math. When a product is the only one on the market, the seller has all the power. They can set high prices because customers have nowhere else to go. But as soon as a competitor shows up with a working alternative, everything changes. Customers suddenly have choices. And choices mean pressure. Here’s what happens step by step:- Competitors enter with a product that matches 80-90% of the original’s features.

- Customers notice they can get the same result for 40-70% less.

- The original vendor loses market share-sometimes fast. In software, first generic entrants capture 25-35% of the market within three months.

- Prices drop to stay competitive. In pharmaceuticals, the first generic drug cuts prices by 76% on average. In electronics, like TVs or headphones, prices fall 30-50% in the first year.

It’s not about the cost of making the product. It’s about the cost of keeping customers.

How It Works in Software (And Why It’s Accelerating)

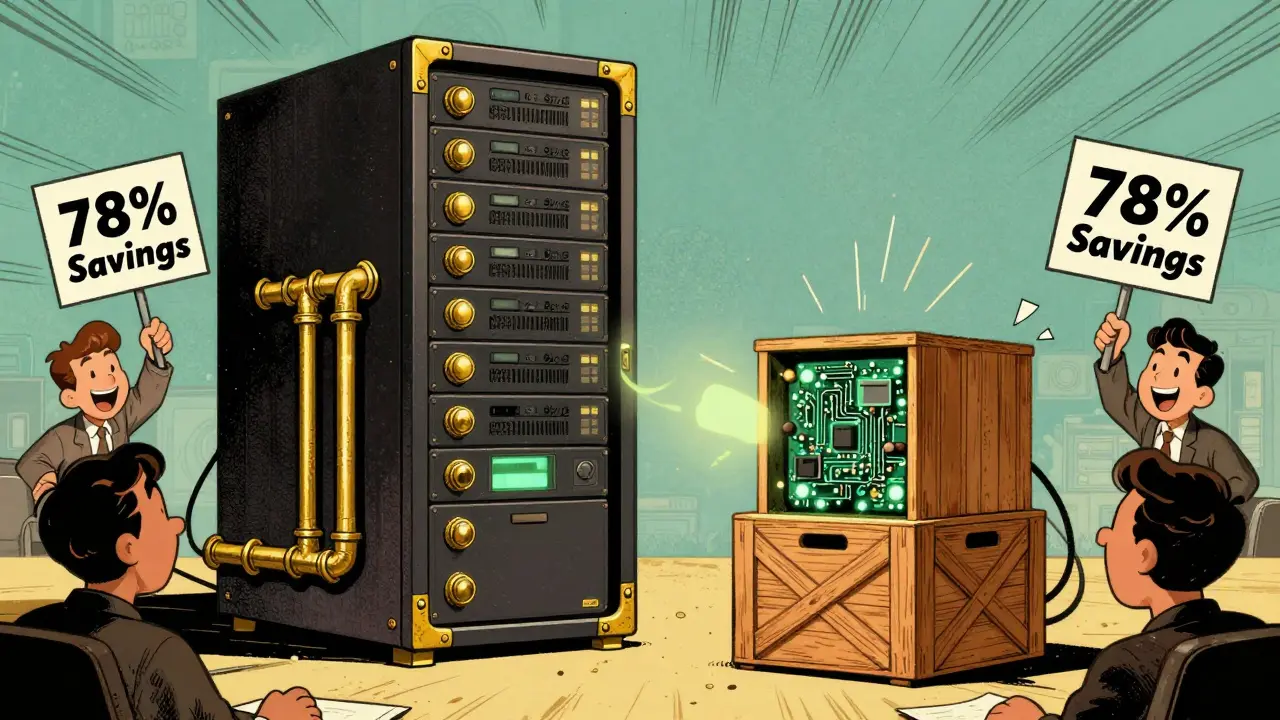

In 2020, enterprise software spending was $412 billion. By 2023, it hit $567 billion-and nearly 18% of that went to first generic alternatives. Why? Because software is now built on open standards. Linux, Apache, PostgreSQL, Kubernetes-these aren’t niche tools. They’re the backbone of modern tech. And they’re free. Take database software. Oracle used to charge hundreds of thousands for a license. Then came PostgreSQL. Same performance. Zero licensing fees. Companies like Netflix, Uber, and Spotify switched. One sysadmin on Reddit said: “We moved from Oracle to PostgreSQL. Licensing costs dropped 78%. Performance? Better.” The shift isn’t just about price. It’s about control. When you use open-source software, you’re not locked in. You can switch providers, hire any developer, and don’t need to beg for support from a single vendor. And vendors are responding. Microsoft cut Azure SQL pricing by 35% after PostgreSQL alternatives gained traction. MongoDB offers a free tier with premium support. These aren’t charity-they’re survival.

The Hidden Cost of Waiting

If you’re a company selling a product, and you wait too long to respond to a generic competitor, you lose money. Fast. A PTC study found that a product launch delayed by 9-12 months can cost 50% of projected revenue. Why? Because customers won’t wait. They’ll try the cheaper option first. And once they do, they rarely go back-even if the original product is “better.” Why? Because good enough beats expensive every time. In 2023, Gartner found that 72% of enterprise buyers now care more about total cost of ownership than brand loyalty. That’s a massive shift. It used to be: “I’ll pay more for IBM.” Now it’s: “I’ll pay less for something that works.”Who Wins? Who Loses?

Winners:- Customers - Pay less. Get more control. Save on licensing, maintenance, and support.

- Startups - They don’t need millions to compete. Just a solid product and open standards.

- Developers - More tools, more flexibility, more job opportunities in open-source ecosystems.

- Legacy vendors who cling to old licensing models. Their revenue drops. Their market share shrinks.

- Customers who delay switching - They keep paying high prices while competitors improve.

Here’s the twist: the first generic entry doesn’t always win long-term. Many early alternatives have poor support, bad documentation, or integration issues. A TrustRadius survey found 28% of early adopters struggled with setup. But here’s the key-they still saved money. And once they got past the initial pain, 81% stuck with the cheaper option.

What’s Next? The Future of Pricing

The trend is accelerating. The time between a product’s launch and its first generic competitor has dropped from 18 months in 2010 to just 6 months in 2023. Why? Because tools are cheaper. Cloud platforms let you deploy software in minutes. Open-source code is free. Developers can build alternatives without permission. ARK Invest predicts that by 2027, open-source alternatives will capture 35% of traditional enterprise software revenue. That’s not a threat-it’s a transformation. Vendors who adapt are thriving. They’re moving from license fees to usage-based pricing. Pay per user. Pay per GB. Pay per API call. This isn’t just a price cut. It’s a new business model.What Should You Do?

If you’re a business buying software:- Don’t assume the brand name = better.

- Test a first generic alternative. Many offer free tiers or trials.

- Calculate total cost-not just license fees. Include setup, training, and support.

- Switch early. You’ll save money and gain flexibility.

If you’re selling software:

- Stop relying on lock-in. Customers aren’t loyal anymore.

- Adopt usage-based pricing. Offer free tiers. Make switching easy.

- Invest in documentation and community. That’s your new competitive edge.

Price drops at launch aren’t accidents. They’re signals. The market is saying: “You’re overcharging.” And if you don’t listen, someone else will.

Why do generic products always launch at such low prices?

Generic products launch low because they don’t carry the costs of brand building, long-term R&D, or legacy infrastructure. They copy what works, strip away the extras, and focus on core functionality. Their goal isn’t to make a profit on the first sale-it’s to win market share fast. Once they have users, they can upsell support, add-ons, or premium features.

Do generic products perform as well as the originals?

In most cases, yes. First generic entries typically match 80-90% of the original’s features. For example, PostgreSQL delivers nearly identical performance to Oracle for most database tasks. The difference isn’t in capability-it’s in polish, support, and integrations. Most businesses don’t need those extras. They need reliability and savings.

Is switching to a generic product risky?

There’s always some risk-especially with early adopters. You might face setup challenges, limited documentation, or slower support. But data shows the risk is worth it: 81% of companies that switch stick with the generic alternative after six months. The savings are real, and the technology is proven. Many enterprises now treat generic options as standard practice, not a gamble.

Why do big companies like Microsoft and Oracle lower their prices?

They don’t have a choice. When PostgreSQL or MongoDB offer the same functionality at 80% less, customers walk away. To survive, these companies had to change their business models. Microsoft shifted Azure SQL to pay-as-you-go pricing. Oracle now offers cloud-based subscriptions. They’re not giving up-they’re adapting to a world where customers control the price.

Can a product avoid a price drop?

Only if it’s truly unique-and even then, only for a short time. If a product solves a problem no one else can, it can hold a premium. But once others reverse-engineer it or build something similar, the price drops. The only way to delay it is to keep innovating. Otherwise, you’re just delaying the inevitable.