When your doctor prescribes a pill that combines two medications - say, a blood pressure drug with a diuretic - you might assume it’s just as cheap as buying the two pills separately. But that’s not always true. In fact, generic combination drugs can cost more than their individual generic components, even when they contain the exact same ingredients. And your insurance plan might make that difference even starker.

Why Insurance Plans Treat Combination Drugs Differently

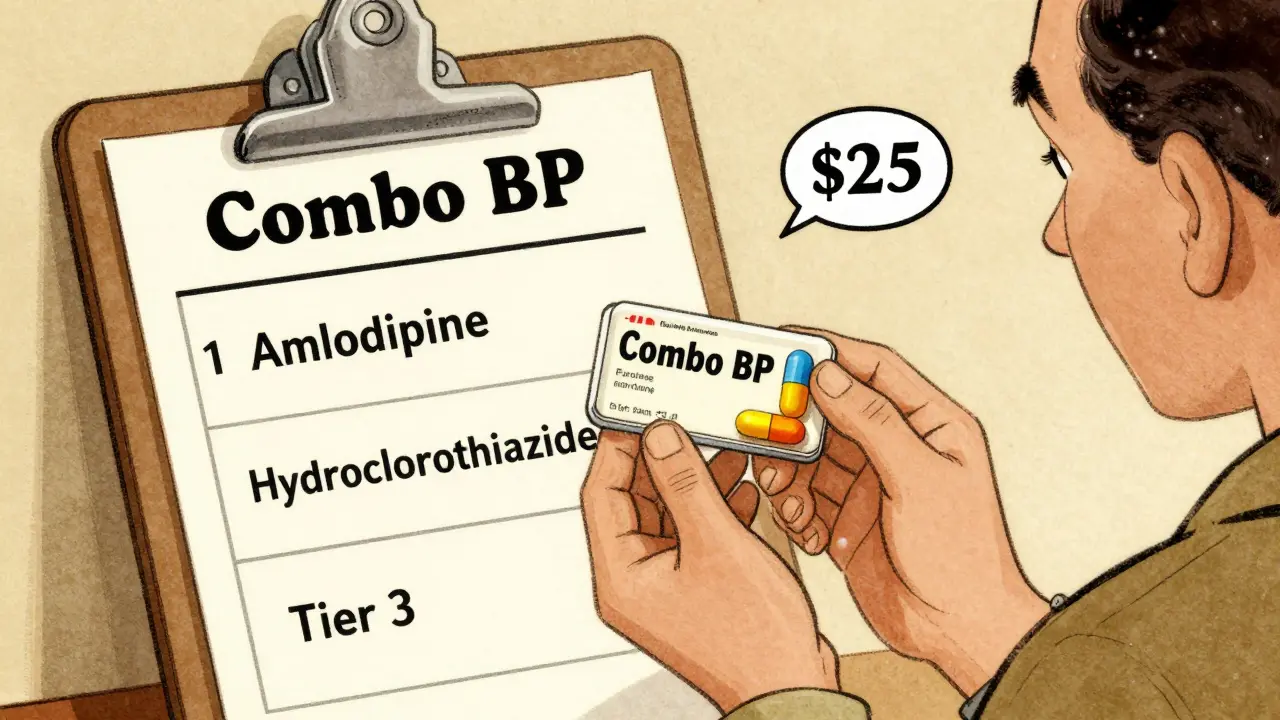

Most U.S. health plans, including Medicare Part D and private insurers, use a tiered system to control drug costs. Tier 1 is for the cheapest drugs - usually generic medications. Tier 2 and above are for brand-name or more expensive generics. Combination drugs, even if they’re generic, don’t always land in Tier 1. Why? Because insurers don’t just look at the ingredients. They look at how the drug is packaged, who manufactures it, and whether it’s easier to manage as a single pill. For example, if you’re taking amlodipine and hydrochlorothiazide separately, each might cost $5 a month. But the combination pill - same two drugs, same doses - could be priced at $25, even if it’s generic. Why? Because the combination version might be a single-source generic, meaning only one company makes it. Without competition, the price doesn’t drop like it does when five companies are selling the same generic.How Medicare Part D Handles Generic Combinations

Medicare Part D plans cover over 84% of prescriptions with generic-only options, according to a 2022 analysis of over 4 million drug combinations. That’s up from 69% in 2012. So yes, plans strongly favor generics. But that doesn’t mean they treat all generics the same. Some Medicare plans cover the combination drug as a single unit. Others require you to get the two individual generics - and then pay for two separate prescriptions. In those cases, you might pay $10 total for both pills. But if your plan only covers the combination, you could pay $40 for the same two drugs in one pill. The key? It depends on your plan’s formulary - the list of drugs they cover and at what cost. A 2023 review by AARP found that only 42% of Medicare Part D plans made their formularies easy to understand online. That means most people don’t know what they’re paying for until they get to the pharmacy.Real Stories: Paying More for the Same Medicine

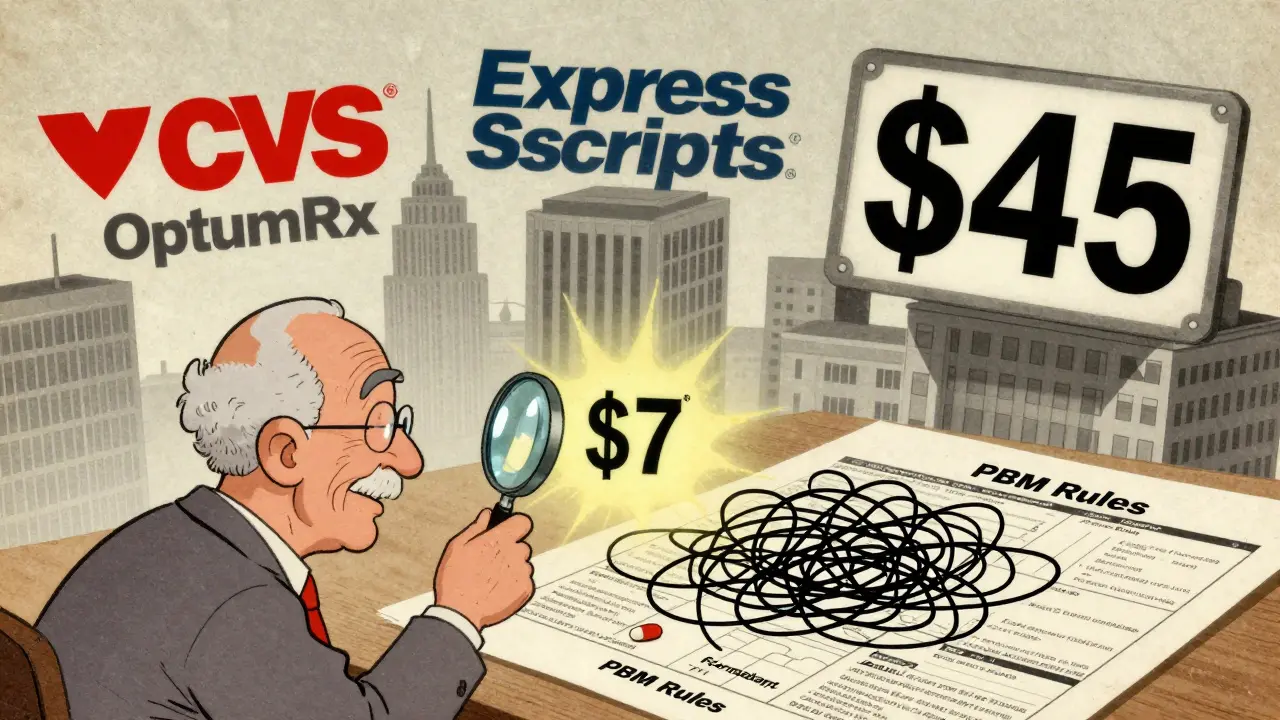

One Reddit user, PharmaPatient87, shared that their plan charged $10 for each individual generic - amlodipine and lisinopril - but $50 for the combination version. They had to ask their doctor to write two separate prescriptions just to save money. Another user, SeniorHealth45, had the opposite experience: when their blood pressure combo went generic, their monthly cost dropped from $45 to $7. No change in how they felt. Just cheaper pricing. This isn’t random. It’s tied to how the drug manufacturer prices the combo and how the pharmacy benefit manager (PBM) - the middleman that negotiates drug prices for insurers - decides to place it in a tier. The three biggest PBMs - CVS Caremark, Express Scripts, and OptumRx - control 80% of the market. Each has its own rules. One might favor the combo. Another might prefer the two separate pills. You don’t get a say.

Why Combination Drugs Sometimes Cost Less

There’s a flip side. When a combination drug goes generic and competes with multiple manufacturers, prices can plummet. Take the combo of metformin and sitagliptin for diabetes. Once three generic makers entered the market, the monthly cost dropped from $150 to under $15. That’s because competition drives prices down - even for combo pills. The FDA says generic drugs are chemically identical to brand-name versions. That’s why insurers push them. But with combination drugs, the manufacturing process is more complex. That can delay generic entry. Once it happens, though, savings can be huge. The average generic drug costs 80-85% less than its brand-name counterpart. For drugs with six or more generic makers, prices can fall by 95%.What You Can Do to Save Money

You don’t have to accept whatever your plan says. Here’s what works:- Check your plan’s formulary - Look up your exact drug name (brand and generic) on your insurer’s website. Search for both the combo and the individual drugs.

- Ask your pharmacist - They can tell you the out-of-pocket cost for both options before you leave the counter.

- Ask your doctor to write separate prescriptions - If the individual generics are cheaper, your doctor can prescribe them as two separate drugs. Many insurers allow this.

- File a coverage appeal - If your plan won’t cover the cheaper option, your doctor can submit a “coverage determination” request. Standard requests take 72 hours; urgent ones get answered in 24.

- Use the Medicare Plan Finder - If you’re on Medicare, this tool shows exactly what each plan charges for your drugs. Compare plans every year during open enrollment.

Write a comment

Your email address will be restricted to us