When a drug has a narrow therapeutic index, even tiny changes in how it’s absorbed by the body can mean the difference between working properly and causing serious harm. This isn’t theoretical-it’s life-or-death. Drugs like warfarin, phenytoin, digoxin, and levothyroxine fall into this category. They treat serious conditions: blood clots, seizures, heart failure, and thyroid disorders. But because the gap between an effective dose and a toxic one is so small, regulators treat generic versions of these drugs with extreme caution. That’s where bridging studies come in.

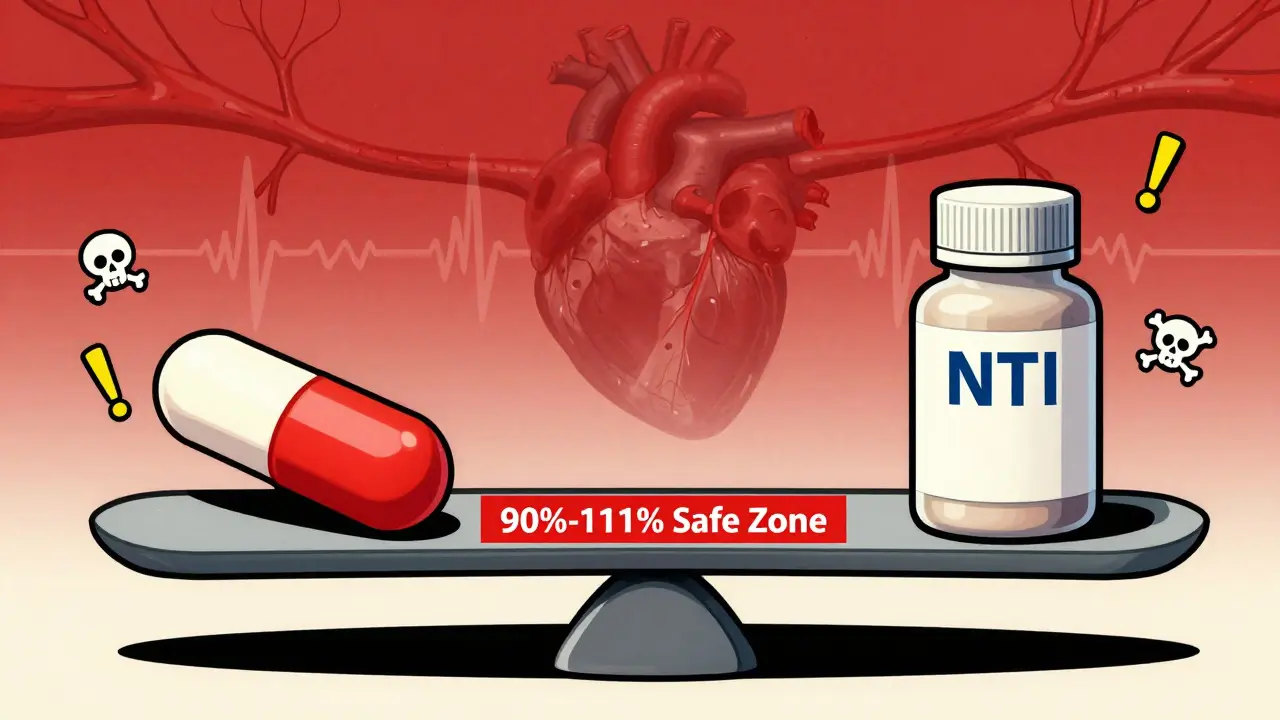

Why NTI Generics Need More Than Standard Bioequivalence

For most generic drugs, proving they work the same as the brand-name version is straightforward. You give a group of healthy volunteers the brand drug and the generic, measure how much of the drug enters the bloodstream (Cmax), and how long it stays there (AUC). If the generic’s levels fall between 80% and 125% of the brand’s, it’s approved. Simple. But for NTI drugs, that range is too wide. A 20% drop in absorption might make the drug ineffective. A 20% rise could trigger dangerous bleeding, seizures, or heart rhythm problems. That’s why regulators don’t use the same rules. The U.S. Food and Drug Administration (FDA) tightened the acceptance criteria for NTI generics to 90.00%-111.11% for both Cmax and AUC. That’s a much narrower window. It’s not just about being close-it’s about being precise. The same applies to the quality of the drug itself. While regular generics can have active ingredient levels between 90% and 110% of the brand, NTI generics must stay within 95%-105%. Any deviation beyond that, and the product gets rejected.The Study Design That Makes NTI Generics So Hard to Develop

Standard bioequivalence studies use a two-way crossover: one group gets the brand first, then the generic; another group gets the generic first, then the brand. For NTI drugs, that’s not enough. The FDA requires a four-way, fully replicated crossover design. That means each participant takes four different versions of the drug over time: the brand twice and the generic twice, in random order. Why? Because NTI drugs often show high variability in how they behave from person to person. The extra data points help regulators understand whether the generic performs consistently across individuals. This design increases the study’s complexity dramatically. Instead of 24-36 volunteers, you need 40-60. Instead of a few weeks, the study lasts 4-6 months. Subject dropout rates jump because of the long duration and frequent blood draws. And the cost? A standard bioequivalence study runs about $1.5-2.5 million. For an NTI drug, it’s $2.5-3.5 million. That’s a 50% increase just for the clinical trial.What Makes a Drug an NTI Drug?

Not every drug with a small safety margin is automatically classified as NTI. The FDA uses five specific criteria to decide:- The minimum effective dose is no more than twice the minimum toxic dose.

- The range of drug concentrations that work is no more than twice the lowest to highest level in the therapeutic window.

- The drug requires routine blood monitoring to adjust the dose.

- Within-subject variability is low or moderate-under 30%.

- Doses are often adjusted in small increments-less than 20% at a time.

Why So Few NTI Generics Make It to Market

Despite NTI drugs making up about 14% of all small-molecule medications, only 6% of generic approvals between 2018 and 2022 were for NTI drugs. Why the gap? It’s not because companies don’t want to make them. It’s because the hurdles are so high. A 2022 survey by the Generic Pharmaceutical Association found that 78% of manufacturers consider NTI drug development “significantly more challenging” than standard generics. The top reason? Bridging study requirements. Sixty-three percent said the complex study design was the biggest barrier. Even after spending millions and years of work, 37% of NTI generic applications get rejected-mostly because the bridging study didn’t meet the strict criteria. That’s more than triple the rejection rate of non-NTI generics. The timeline is longer too. Standard generics take 2-3 years from start to approval. NTI generics? 3-5 years. The bioequivalence study alone takes 12-18 months, compared to 6-9 months for regular drugs. And only 35% of generic companies have the in-house expertise to run these studies. Many have to hire consultants, train staff, or partner with specialized CROs-adding more time and cost.Regulatory Differences Around the World

The FDA isn’t alone in demanding stricter rules. The European Medicines Agency (EMA) also requires tailored bioequivalence approaches for NTI drugs. In 2022, the EMA’s Committee for Medicinal Products for Human Use (CHMP) explicitly stated that NTI drugs cannot have their bridging requirements waived based on “product similarity” alone. That’s a direct rebuke to industry proposals suggesting some NTI drugs might be exempt. The International Council for Harmonisation (ICH) is trying to align global standards. Their E18 guideline update, due in 2025, will address ethnic differences in NTI drug response-something that’s become more important as generics are developed in Asia and sold in Europe or the U.S. But for now, there’s still no global standard. A generic approved in the U.S. might need additional studies to be approved in the EU, and vice versa. That fragmentation slows down market access and increases development costs.The Role of New Technologies

There’s hope on the horizon. Physiologically-based pharmacokinetic (PBPK) modeling is emerging as a tool that could reduce the need for massive clinical trials. PBPK uses computer simulations to predict how a drug behaves in the body based on its chemical properties, the formulation, and human physiology. In a 2022 pilot study, the FDA tested PBPK models for warfarin generics and found they could accurately predict bioequivalence without full-scale human trials. But regulators aren’t ready to replace clinical data yet. Dr. Sally Sepehrara of the FDA’s Office of Generic Drugs said in 2023: “For the foreseeable future, robust clinical data will remain essential for NTI drug approval.” The agency is using PBPK as a supplement-not a substitute. It might help reduce the number of subjects needed or refine study design, but it won’t eliminate the need for human testing.

What This Means for Patients

The bottom line? NTI generics are harder to make, take longer to approve, and cost more. That’s why only 42% of the NTI drug market is covered by generics, compared to 85% for non-NTI drugs. Patients who rely on these medications-people on warfarin after a stroke, or levothyroxine for hypothyroidism-often face higher costs and fewer choices. Switching between brands and generics can be risky if the bioequivalence isn’t proven with the same rigor. But the potential is huge. The global NTI drug market was worth $78.5 billion in 2022 and is projected to grow to over $100 billion by 2028. If generic manufacturers can overcome the barriers, they could unlock $32.8 billion in savings by 2025. That’s money that could go toward better care, fewer hospitalizations, and more accessible treatment.How Companies Are Adapting

Leading manufacturers are investing in specialized teams. Teva Pharmaceuticals, for example, now has dedicated pharmacokinetic and statistical experts who focus solely on NTI drugs. They’ve learned that early engagement with regulators makes a huge difference. The FDA’s pre-ANDA meeting process-where companies can consult with regulators before starting studies-is used by 82% of NTI applicants. Those who use it report 20-30% reductions in development time and cost. The FDA also runs a pilot program for complex generics, including NTI drugs. Companies in the program see review times drop by 25%. That’s a big win when you’re already spending years and millions of dollars.The Path Forward

Bridging studies for NTI generics aren’t going away. They’re necessary. But they’re also a bottleneck. The challenge for regulators, manufacturers, and patients is to find a balance: ensuring safety without stifling access. Advances in modeling, better study designs, and global harmonization could help. But until then, the truth remains: if a drug has a narrow therapeutic index, the rules must be strict. Because when the margin for error is this small, there’s no room for compromise.What is a narrow therapeutic index (NTI) drug?

A narrow therapeutic index (NTI) drug is a medication where the difference between an effective dose and a toxic dose is very small. Even minor changes in how the drug is absorbed can lead to treatment failure or serious side effects. Examples include warfarin, phenytoin, digoxin, and levothyroxine. Regulators classify a drug as NTI if it meets specific criteria, such as requiring routine blood monitoring, having a low within-subject variability, and needing small dose adjustments.

Why can’t NTI generics use the same bioequivalence standards as regular generics?

Standard generics use an 80%-125% bioequivalence range, but that’s too wide for NTI drugs. A 20% drop in absorption could make the drug ineffective; a 20% rise could cause toxicity. For NTI drugs, regulators require a tighter range: 90.00%-111.11% for both Cmax and AUC. This ensures the generic performs as safely and reliably as the brand-name version.

What study design is required for NTI generic approval?

The FDA requires a four-way, fully replicated crossover design. Each participant receives the brand drug twice and the generic drug twice, in random order. This helps account for high variability in how patients respond. Standard generics use a two-way crossover, but that’s not sufficient for NTI drugs because of the risk of clinical consequences from small differences.

How much more expensive is developing an NTI generic?

Developing an NTI generic costs 30-50% more than a standard generic. The bioequivalence study alone runs $2.5-3.5 million, compared to $1.5-2.5 million for non-NTI drugs. This is due to larger sample sizes, longer study durations, more complex analysis, and higher regulatory scrutiny. Many companies also need to hire specialized experts, adding to the cost.

Why are so few NTI generics approved?

Between 2018 and 2022, only 18 NTI generics were approved by the FDA, compared to over 1,000 non-NTI generics. The main reasons are the high cost and complexity of bridging studies, the strict acceptance criteria, and the high rate of rejection-37% of NTI applications are rejected due to inadequate study design. Fewer than one-third of generic manufacturers have the internal expertise to run these studies, making NTI development a high-risk, high-cost endeavor.

Will new technologies like PBPK modeling replace bridging studies?

PBPK modeling shows promise and is being used by the FDA to support NTI drug applications, but it’s not yet a replacement for clinical data. In pilot studies, it accurately predicted bioequivalence for warfarin generics. However, regulators still require robust clinical trials to confirm safety. PBPK may reduce the number of subjects needed or help optimize study design, but for now, human data remains essential.

What’s the market opportunity for NTI generics?

The global NTI drug market was valued at $78.5 billion in 2022 and is expected to grow at 5.2% annually through 2028. However, generic penetration is only 42%, compared to 85% for non-NTI drugs. That leaves a $32.8 billion opportunity by 2025. If manufacturers can overcome regulatory and cost barriers, NTI generics could significantly reduce healthcare spending while maintaining patient safety.

Write a comment

Your email address will be restricted to us