When you pick up a prescription at the pharmacy, you might not think twice about whether it’s a brand-name pill or a generic. But for doctors and pharmacists around the world, that choice isn’t just about price-it’s about trust, access, and survival. In some countries, generics are the backbone of public health. In others, they’re still met with hesitation. The truth? How providers see generics depends entirely on where they practice.

Europe: Generics as Policy, Not Just Preference

In Germany, France, and the UK, doctors don’t just accept generics-they’re expected to prescribe them. Government policies push pharmacists to swap brand-name drugs for generics unless a doctor specifically says no. In Germany alone, more than 80% of prescriptions are filled with generics. It’s not because patients ask for them-it’s because the system demands it. European providers don’t see generics as a compromise. They see them as a tool to keep healthcare affordable. With aging populations and rising costs, there’s no room for luxury prescriptions. A blood pressure pill that costs €0.10 instead of €5? That’s not a bargain-it’s a necessity. The EU’s generic market hit €122 billion in 2025, and growth is slow but steady. Providers know the system works. They’ve seen patients stick to treatment because they can actually afford it. But there’s a quiet tension. Some older physicians still hesitate with complex drugs-like injectables or inhalers-wondering if the generic version behaves exactly the same. That’s changing, though. As more specialty generics enter the market, providers are learning that quality isn’t tied to the brand name.India and Asia-Pacific: Generics Are the Default

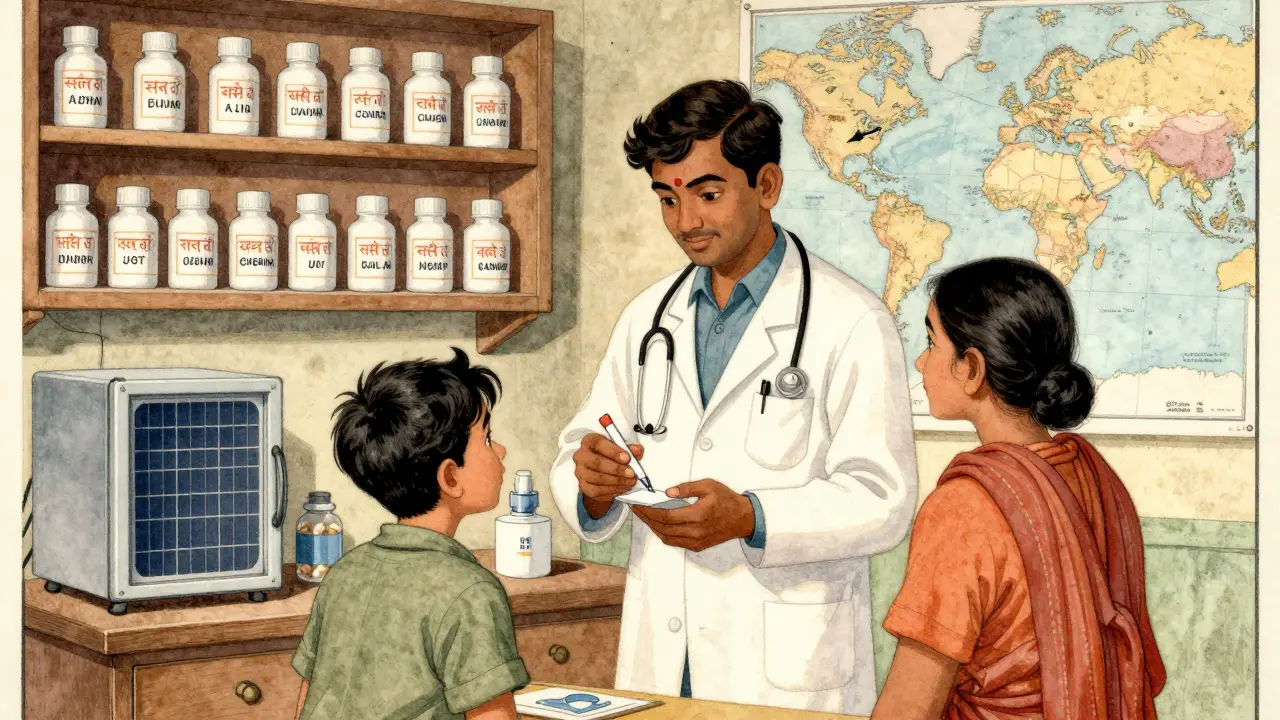

In India, generics aren’t just common-they’re the foundation of the entire healthcare system. Indian manufacturers produce about 20% of the world’s generic drug volume. They supply nearly 40% of all generic medicines used in the United States. That’s not luck. It’s strategy. Indian doctors don’t debate whether to prescribe generics. They assume it. Why? Because most patients can’t pay for branded drugs. A diabetic patient in rural Uttar Pradesh doesn’t get to choose between Novo Nordisk and a generic insulin. They get what’s available-and affordable. Providers in India, China, and Indonesia treat generics as essential infrastructure, like clean water or electricity. The region’s growth is explosive. Asia-Pacific is projected to grow at over 6% per year through 2034. Why? Aging populations, rising chronic diseases like diabetes and heart failure, and governments actively pushing generics. In China, the state has cut drug prices twice a year since 2018. Doctors there now write prescriptions with generics in mind before even considering the brand. The global supply chain runs through Asia. When a U.S. pharmacy runs out of metformin, it’s often an Indian factory that fills the gap. Providers in the West rely on this-but they don’t always admit it.United States: High Volume, Low Trust

In the U.S., generics make up 90% of prescriptions. That sounds like total adoption. But here’s the catch: they only account for about 15% of total drug spending. Why? Because brand-name drugs still cost 10 to 20 times more. A patient might get a generic statin, but their insulin, cancer drug, or asthma inhaler? Still branded. And expensive. American providers want generics. They tell patients: “This works just as well and saves you hundreds.” But they also worry. Drug shortages happen more often with generics. A batch of generic epinephrine auto-injectors gets recalled. A supply chain hiccup delays generic antibiotics. Suddenly, doctors are scrambling. There’s also lingering doubt. Some providers remember the early 2000s, when poor-quality generics flooded the market. Even today, a few still say, “I trust the brand.” But younger doctors? They’re different. They’ve grown up seeing generics work. They know the FDA requires generics to match brand drugs in strength, safety, and effectiveness. The data is clear. The trust gap is closing-slowly. What’s changing? The wave of patent expirations. Starting in 2025, drugs like ustekinumab and vedolizumab-each bringing in billions-will go generic. That’s $25 billion in new generic opportunity in oncology and immunology alone. Providers are watching. They know this will force a reckoning: if a $20,000-a-year biologic becomes a $200 generic, will they still hesitate?

Japan: Price Cuts and Patient Compliance

Japan has a unique approach: biennial price cuts. Every two years, the government forces drugmakers to lower prices across the board-brands and generics alike. The result? A flat or slightly shrinking pharmaceutical market, even as new drugs arrive. Japanese doctors don’t have to convince patients to use generics. The system already did it for them. Generics are the first option. Brand names are the exception. The focus isn’t on trust-it’s on compliance. If a patient can’t afford their medication, they won’t take it. Generics fix that. The result? Higher adherence rates. Lower hospital readmissions. Japan’s system proves that when cost is removed as a barrier, outcomes improve. Providers there see generics not as a budget item, but as a public health win.Emerging Markets: Generics as Lifelines

In Brazil, Turkey, and parts of Africa, generics aren’t a choice-they’re the only choice. Healthcare budgets are tight. Insurance is patchy. When a child needs antibiotics or a grandmother needs hypertension meds, the only option is the generic. Providers in these regions don’t have the luxury of preference. They don’t ask, “Is this generic safe?” They ask, “Will this keep them alive?” And the answer is almost always yes. IQVIA estimates that emerging markets will add $140 billion in drug spending by 2025-almost all of it on generics. Why? Because that’s what people can afford. Providers in these countries are the frontline of global health equity. They don’t need studies to tell them generics work. They see it every day.

Write a comment

Your email address will be restricted to us