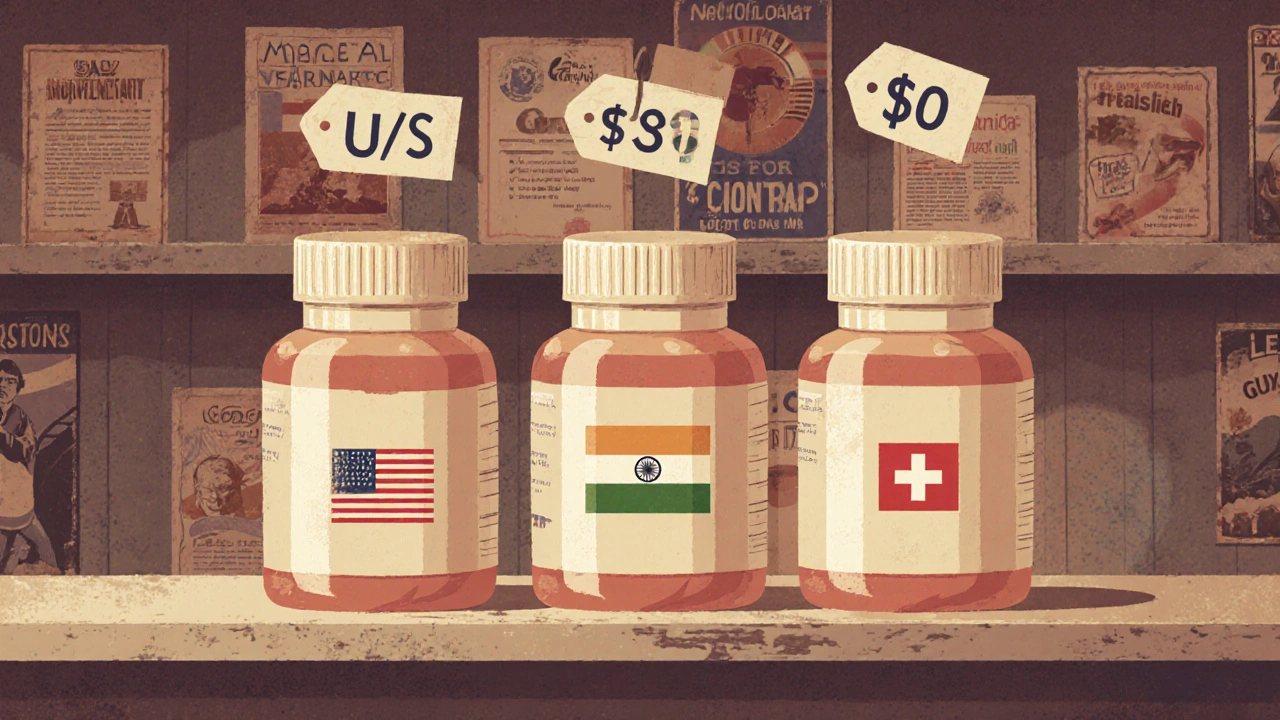

Same pill. Same active ingredient. Same dosage. But in the U.S., it might cost $120. In India, $3. In Switzerland, $90. Why does this happen? It’s not about quality control alone. It’s not just about patents. It’s about how each country chooses to run its healthcare system - and who gets to decide what you pay for the medicine you need.

How Much of the World Uses Generic Drugs?

The numbers don’t lie. Around the world, generic drugs make up between 50% and 90% of all prescriptions filled. But that average hides a wild divide. In the United Kingdom, 83% of all prescriptions are for generics. In Germany, it’s 80%. In the Netherlands, 70%. These countries have systems that push pharmacies to substitute brand names with cheaper versions as soon as the patent expires. Now look at Switzerland. Only 17% of prescriptions are for generics. Italy? Just 19%. Greece? 20%. Why? It’s not that doctors there don’t know generics work. It’s that the system doesn’t reward substitution. Patients often expect the brand name. Pharmacists aren’t required to switch. And sometimes, insurers pay the same for both - so there’s no financial incentive to choose the cheaper option. The U.S. is a puzzle. It fills over 90% of prescriptions with generics - the highest rate in the world. But it still pays more for those generics than almost any other country. In 2022, the average price of all drugs (brand and generic) in the U.S. was 2.78 times higher than in other wealthy nations. You get more generics, but you pay more for them.Why Do Prices Vary So Much?

Price differences aren’t random. They’re built into the system. In countries like the U.K. and Germany, the government negotiates prices directly with manufacturers. Once a drug goes generic, they hold auctions. The lowest bidder gets the contract. That drives prices down - sometimes to pennies per pill. In the U.S., there’s no central negotiation. Prices are set by pharmacies, insurers, and middlemen. A single generic drug can cost $5 in a public pharmacy in India, $10 in a U.S. Walmart, and $40 in a Swiss pharmacy - all the exact same tablet. Manufacturing location matters too. India produces about 20% of the world’s generic drugs - and 40% of the ones used in the U.S. There are over 750 Indian factories approved by the U.S. FDA. But here’s the catch: the same company might make the same pill for different markets using different processes. A 2023 study from Ohio State University found that generics made in India had a 54% higher rate of severe side effects - like hospitalizations or death - compared to identical pills made in the U.S. Not because they’re fake. Because cost-cutting changes the formulation. Less binder. Different coating. Slower release.Who Makes These Drugs - And Where?

India is the engine. But China is catching up fast. In 2010, China had 12 FDA-approved manufacturing sites. By 2023, that jumped to 187. That’s not just volume - it’s a shift in global supply chains. Many U.S. and European pharmacies now source generics from China because it’s cheaper. But quality concerns remain. The FDA’s inspections show a higher rate of violations at Chinese and Indian plants compared to U.S.-based ones. The U.S. FDA inspects foreign factories, but here’s the problem: they often give advance notice. That means factories can clean up, fix records, and hide issues before inspectors arrive. In the U.S., inspections are unannounced. That’s why some doctors report patients having bad reactions to Indian-made generics - the same drug, but made under different conditions. In Europe, the EMA sets standards, but each country still approves each generic separately. That adds 18 to 24 months to market entry. In the U.S., a generic can hit shelves in 3-6 months after patent expiry - if there’s enough competition.

Competition - Or Lack of It

More manufacturers usually mean lower prices. In the U.S., 66% of off-patent drugs have two or more generic makers. In the U.K., it’s 50%. In Canada, 43%. But here’s the twist: even with multiple makers, prices don’t always drop. In the U.S., a drug like metformin - used by millions for diabetes - has over 50 generic brands. Yet, in 2023, one company suddenly raised the price by 300% because another manufacturer stopped making it. No one else stepped in. Why? Because the profit margin was too thin. That’s the dark side of the generic market. When prices get too low, manufacturers leave. And when one company controls the only supply, prices spike. That’s what happened with the antibiotic doxycycline in 2021. One company made 90% of it in the U.S. When they had a quality issue, the price jumped from $10 to $1,800 for a 30-day supply. That’s not a market failure. That’s a system designed for low margins and no backup.What Happens When You Travel?

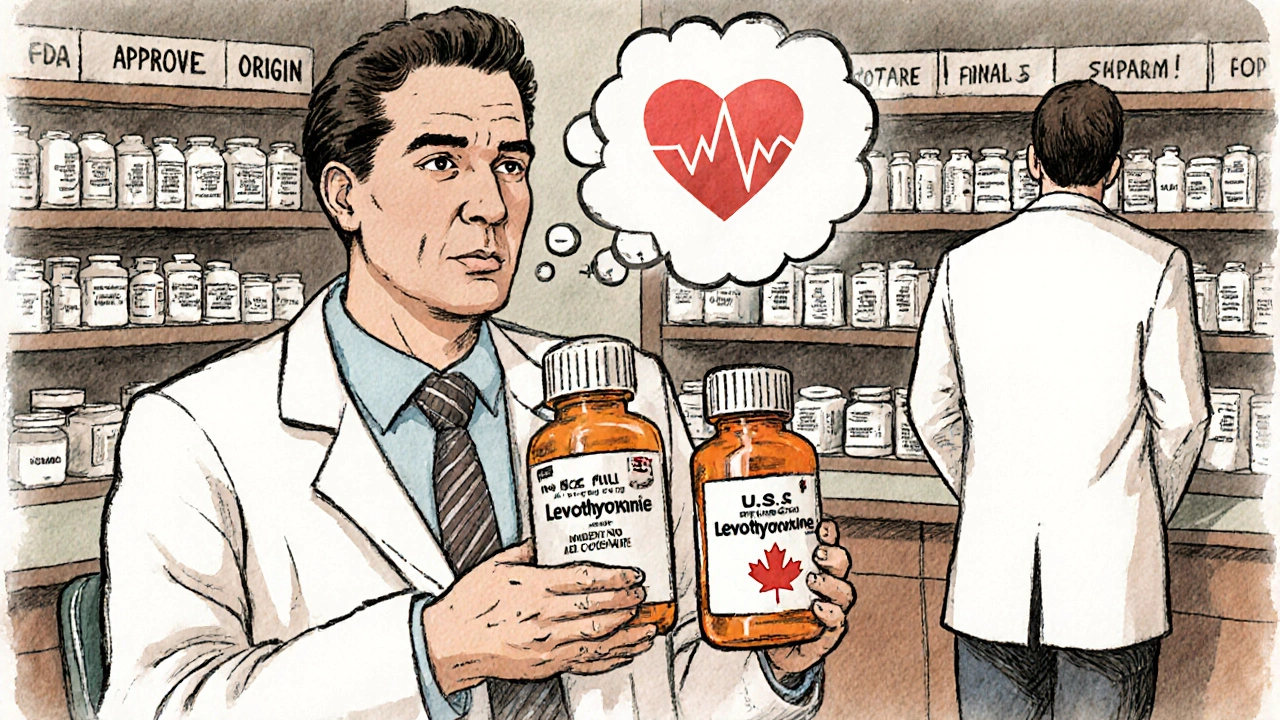

If you’re a U.S. patient traveling to Canada or Europe, don’t assume your generic will work the same. A doctor in Chicago reported a patient who switched from a U.S.-made generic levothyroxine to a Canadian version - and ended up in the ER with heart palpitations. The active ingredient was the same. But the fillers, the coating, the release mechanism? Different. The body absorbed it differently. Reddit threads are full of stories like this. People buy cheaper generics from Canadian pharmacies online. They feel fine at first. Then, after a few months, they get headaches, nausea, or their blood pressure goes haywire. They switch back. Symptoms disappear. The pills are legal. They’re not counterfeit. But they’re not identical. In Germany, pharmacists are required to switch to generics. In Switzerland, they’re not. In the U.S., it depends on the state. Some states let pharmacists substitute automatically. Others require the doctor’s permission. So if you move from New York to Texas, your prescription might change - not because your condition changed, but because the rules did.

The Future: Can This Be Fixed?

There are signs of change. The U.S. Inflation Reduction Act of 2022 is pushing the FDA to speed up generic reviews by 30%. The European Union wants 80% generic use by 2030. The WHO is creating a global tool to measure generic quality across countries. But the biggest hurdle isn’t science. It’s politics. Drug companies still find ways to delay generics - like making tiny changes to a pill (a new coating, a different salt form) and getting a new patent. That’s called “evergreening.” Between 2015 and 2022, over 1,200 such patents were filed on just 12 top-selling drugs. AI might help. By 2030, machine learning could cut generic development time from 5 years to 2. That means more competition, faster. But only if regulators keep up. Right now, each country has its own rules. Harmonizing them could save billions - and save lives.What This Means for You

If you’re on a generic drug:- Don’t assume all versions are the same - even if the name is identical.

- If you switch pharmacies or countries and feel different, tell your doctor. It might be the pill.

- Ask if your pharmacy sources from U.S.- or EU-approved manufacturers. Avoid ones with unclear origins.

- Don’t assume cheaper = better. Sometimes, the higher price reflects stricter quality control.

- Know your country’s rules. In the U.K., substitution is automatic. In the U.S., you may need to ask.

Write a comment

Your email address will be restricted to us