Medicare Part D doesn’t just hand out prescriptions-it’s a carefully engineered economic system built to save billions by pushing one simple idea: generics work just as well, and cost a fraction of the price.

How Part D Makes Generics the Default Choice

Every Medicare Part D plan uses a tiered formulary, like a pricing ladder for drugs. At the bottom? Tier 1: preferred generics. These are the cheapest options, often $0 to $10 for a 30-day supply. Above them? Tier 2: non-preferred generics, usually $15 or so. Then come brand-name drugs in Tier 3, then specialty drugs in Tiers 4 and 5. The system doesn’t just list drugs-it incentivizes them. If you pick a generic, you pay less. If you pick a brand, you pay more. It’s that straightforward.In 2023, 87.3% of all Part D prescriptions were for generics. That’s not an accident. It’s the result of a design that makes generics the easiest, cheapest path. Plans are required by CMS to include at least two drugs in each of 148 therapeutic categories, and they’re heavily encouraged to put generics in the lowest tiers. The math is simple: if a generic costs $18.75 per prescription and the brand costs $156.42, the plan saves $137.67 per fill. Multiply that by hundreds of millions of fills a year, and you’re talking about billions saved.

The Real Savings: What You Pay vs. What the Program Pays

You might think, “If generics are so cheap, why do I still pay $15?” The answer lies in how Part D spreads the cost. During the initial coverage phase, you pay 25% of the drug’s price-whether it’s generic or brand. But here’s the catch: 25% of $10 is $2.50. 25% of $75 is $18.75. So even though your coinsurance rate is the same, the dollar amount you pay isn’t. A 30-day supply of a generic blood pressure drug like amlodipine might cost you $0 at a preferred pharmacy. The brand version, Norvasc? $45. That’s $540 a year just on one drug.And it gets better. Once you hit the coverage gap-the old “donut hole”-you still pay only 25% of the negotiated price for generics. That’s down from 44% in 2019. In catastrophic coverage, you pay either 5% of the cost or a flat copay: $4.15 for generics, $10.35 for brands. So if you’re on multiple medications, the difference adds up fast. One beneficiary on Reddit reported saving $2,340 a year just by switching from brand to generic thyroid medication.

Why Generics Dominate-Even When Brands Are Cheaper

There’s a twist: sometimes, the brand-name drug costs less than the generic. How? Because manufacturers offer coupons or rebates directly to patients, but Part D plans can’t use them. So if you have a $50 coupon for a brand-name drug, your plan still charges you the full list price. That’s why some people end up paying more for the brand. But here’s the thing: those cases are rare. In 2023, only 1.2% of Part D prescriptions saw this flip. For most drugs, generics are still the clear winner.And the system is getting smarter. Starting in 2025, manufacturers must give Part D plans additional discounts on certain drugs during both the initial coverage and catastrophic phases. This is called the Manufacturer Discount Program. It’s designed to push even more generics into use. Experts predict generic market share will hit 91.5% by 2027. That’s not just a trend-it’s a policy goal.

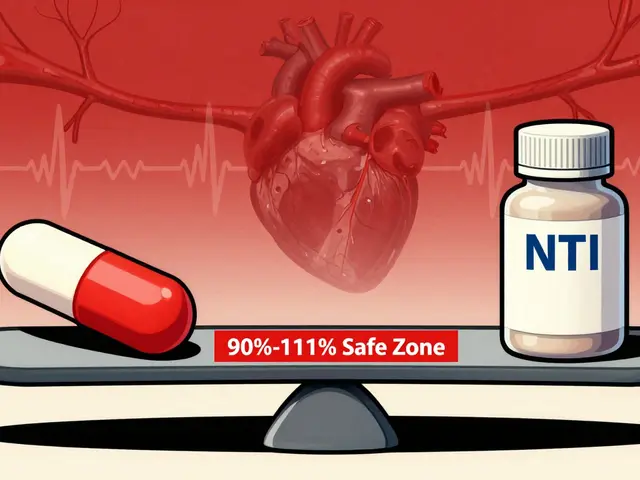

Protected Classes: When Generics Don’t Always Win

Not all drugs are treated the same. Six classes are protected: anti-cancer, anti-psychotic, anti-convulsant, anti-depressant, immunosuppressant, and anti-retroviral. For these, plans must cover “substantially all” drugs-both brand and generic. Why? Because switching can be dangerous. A patient on a specific anti-seizure med might have bad reactions if swapped to a generic, even if it’s chemically identical. So in these cases, formularies can’t push generics as aggressively. But even here, generics are still preferred. In fact, 85% of prescriptions in these categories are still for generics-just because they’re cheaper and just as effective for most people.How Beneficiaries Can Maximize Savings

If you’re on Medicare Part D, your savings depend on what you do during the Annual Enrollment Period (October 15 to December 7). Most people don’t check their plan’s formulary. That’s a mistake. One study found beneficiaries who used Medicare.gov’s Plan Finder tool saved an average of $427 a year just by switching to a plan with better generic coverage.Here’s what to look for:

- Is your drug on Tier 1? If not, ask if there’s a generic alternative.

- Does the plan have $0 copays for preferred generics? 42.3% of plans did in 2024.

- Are there prior authorizations or step therapy rules for your meds? Even generics can be blocked if they’re in a higher tier.

- Is your pharmacy in-network? Preferred pharmacies often have lower copays.

Also, pharmacists can automatically switch your brand to a generic unless you write “dispense as written” on the prescription. That’s legal and common-but you should know it’s happening. If you’ve had side effects from a generic before, tell your doctor and pharmacist. You can request a “coverage determination” to get the brand covered. CMS approves these requests 78.4% of the time.

The Hidden Problem: Formulary Changes and Cost Shocks

Here’s where things get messy. Plans can change their formularies mid-year. A generic you’ve been using for years might suddenly move from Tier 1 to Tier 3. Your copay jumps from $0 to $30. That happened to 18.7% of beneficiaries in 2023, according to CMS complaints. And if you’re on a fixed income, that’s not just inconvenient-it’s dangerous. One in three low-income beneficiaries still skip doses because they can’t afford even the generic copay.The $2,000 out-of-pocket cap starting in 2025 will help. Once you hit that cap, you pay nothing for the rest of the year. That’s huge for people on multiple expensive meds. But it doesn’t fix the formulary shuffle problem. You still need to check your plan every year.

The Bigger Picture: Why Generics Keep Part D Alive

Medicare Part D spent $198.4 billion in 2023. Generics made up only 24.1% of that spending-but 87.3% of the prescriptions. That’s the power of volume and low cost. Without generics, the program would be unaffordable. The Congressional Budget Office estimates generic use saves the federal government $14.2 billion a year in subsidies and catastrophic payments. Harvard’s Dr. Richard Frank called the tiered formulary “instrumental” in reducing program costs by $1.37 trillion since 2006.But it’s not just about money. It’s about access. Generics let millions of seniors afford their meds. Without them, many would choose between food and medicine. The system isn’t perfect-formulary changes, hidden costs, and inconsistent coverage still cause stress. But the core idea works: if you make the right choice easy and cheap, most people will make it.

The future of Part D depends on keeping that momentum. With new manufacturer discounts, caps on out-of-pocket spending, and stricter formulary rules, generics will only grow in importance. By 2030, experts expect 91.5% of Part D prescriptions to be generics. That’s not just a statistic-it’s a lifeline.

Why are generic drugs cheaper than brand-name drugs in Medicare Part D?

Generic drugs are cheaper because they don’t require the same research, development, and marketing costs as brand-name drugs. Once a brand’s patent expires, other manufacturers can produce the same active ingredient at a fraction of the cost. Medicare Part D plans take advantage of this by placing generics in the lowest-cost tiers, encouraging beneficiaries to choose them. In 2023, the average cost per generic prescription was $18.75, compared to $156.42 for brand-name drugs.

Do all Medicare Part D plans cover the same generic drugs?

No. Each plan designs its own formulary, meaning the list of covered drugs and their tiers can vary widely. A generic that’s in Tier 1 on one plan might be in Tier 3 on another-or not covered at all. That’s why it’s critical to check your plan’s formulary during the Annual Enrollment Period. A 2023 CMS report found that 63.2% of beneficiaries would pay more if they switched plans without reviewing formulary differences.

Can I be forced to switch from a brand-name drug to a generic?

Yes, pharmacists can automatically substitute a generic for a brand-name drug unless your prescription says “dispense as written.” This is called therapeutic interchange and happens in nearly 60% of generic fills. If you’ve had side effects from a generic before, tell your doctor. You can request a “coverage determination” to get the brand covered, and CMS approves these requests 78.4% of the time.

How does the $2,000 out-of-pocket cap in 2025 affect generic use?

The $2,000 cap means once you’ve spent that much in a year on covered drugs, you pay nothing for the rest of the year. This removes the financial barrier to using high-cost generics in specialty tiers. Before, people might delay filling prescriptions to avoid hitting the gap. Now, they can use what they need without fear of high costs. Experts predict this will increase generic use, especially for expensive medications like those for autoimmune diseases or cancer.

Why are some generics still expensive in Part D?

Some generics are priced high because they’re made by a single manufacturer with little competition, or because of supply chain issues. Others are placed in higher tiers (Tier 3 or 4) by plans that want to steer people toward cheaper alternatives-even if the generic is chemically identical. This is especially common with specialty generics. Always check your plan’s formulary and ask if there’s a lower-cost option.

Write a comment

Your email address will be restricted to us